Reasons To Cheer

[ Update to Investing in Greece ]

Greece’s long-term credit rating was raised in March by Moody’s by two notches from B3 to B1 with a stable outlook. In the process, Moody’s noted that the “ongoing reform effort is slowly starting to bear fruit in the economy.”

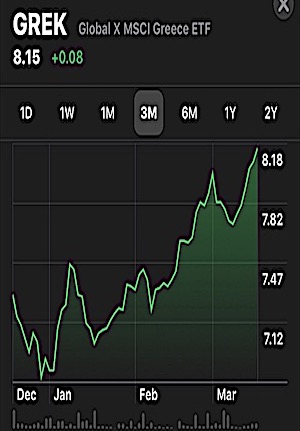

In a recent note, Global X ETFs exchange provider, notes “Greece’s stock market is off to a strong start in 2019, helped by the country’s broad economic growth reaching its fastest annual increase since 2007. In Q1, the markets were up 15.2% and forecasts put 2019 GDP growth at annualized 2.4%, versus Europe at just 1.3%”.

“Further powering returns was a recovery in consumer confidence to almost pre-crisis levels,” said Global X. “Private consumption helped drive in strong performance during Q1 within the communication services sector and the casinos & gaming sub-industry. Such improvements follow labor gains with unemployment falling by 3% in 2018 and national account data reflecting improvements in labor productivity.”

in 2019, we see a healthy rise on the indicators shown below. The GREK fund is a good indicator since represents 17% weight to consumer discretionary stocks. This means strengthening of the Greek consumers.